how much does the uk raise in taxes

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. It wishes to be the party of sound public finances but also wants to avoid raising taxes.

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Income

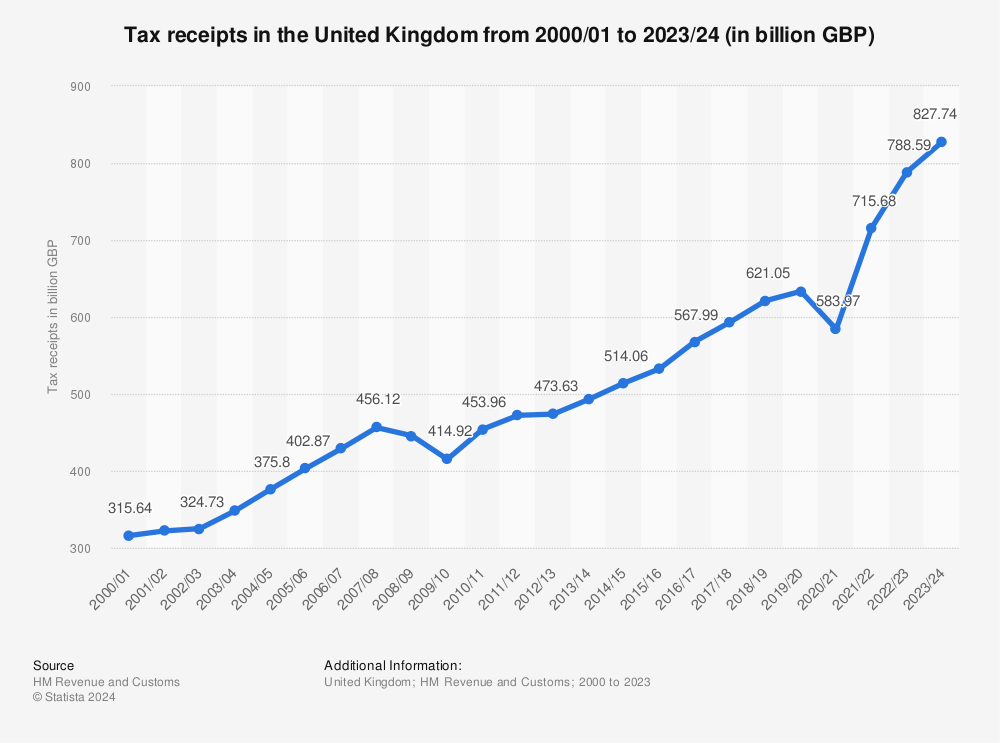

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds.

. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019. Since 200001 this total has increased by 89 billion. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

Overall the average household pays 12000 in tax and receives 5000 in benefits. Total tax receipts in 201718 are forecast to be 690 billion. This is equivalent to around 39 of the size of the UK economy as measured by GDP which is the highest level since the 1980s.

In 202122 income tax receipts in the United Kingdom amounted to 1573 billion British pounds which when compared with 200001 was a net increase of nearly 100 billion pounds. This represented a net. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont.

From 229 in total income taxes it is anticipated that receipts will increase. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. In 202021 the UK Government is expected to receive 873 billion of public sector current receipts.

This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of national income. The main reason that income tax is the biggest source of revenue is that personal income makes up the majority of total national income. In 202122 UK government raised over 915 billion a year in receipts income from taxes and other sources.

Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since the end of the second world war and been rising since the early 1990s. A 1 tax on the use of the policy would be raised by Labour the party claimed. In 2021-22 we estimate that income tax will raise 2132 billion.

The richest 10 pay over 30000 in tax mostly direct income tax. By 2025 26 billion people will have access to. However inequality in the UK has increased since 1980.

Amazon and other tech. Much of the revenue initially. A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century.

UK tax revenues were equivalent to 33 of GDP in 2019. United Kingdom UK finance minister Sunak resigns article with image July 5 2022 United Kingdom British health minister Javid resigns plunging government into chaos article with image July 5 2022. Prime Minister Boris Johnson has also ruled out cuts to public services and pledged not.

But receive over 5000 in tax credits and benefits. How much does the UK raise in tax compared to other countries. In 201920 income tax receipts in the United Kingdom amounted to 194 billion.

Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

That would be an extra 91000 in tax revenue per person. From 168 billion in 202122 to 6 billion in 202223. The UK raised 35 of national income in tax in 201819.

In most states renters must be granted at least 30 days notice before a rent increase is enforced although that can vary based on. In line with inflation there will be an increase in allowances and the basic rate limit. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty.

The firm paid 492m in direct taxation as its sales rose 50 to 2063bn amid a Covid-driven surge in demand. They receive around 2000 in benefits. How much does the UK raise in tax compared to other countries.

How To Pay Taxes On A Credit Card And Get Rewards Business Credit Cards Credit Card Payoff Plan Credit Card

Average U S Income Tax Rate By Income Percentile 2019 Statista

Income Tax In The Uk And France Compared Frenchentree

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

How Do Income Taxes Affect The Economy Tax Foundation

Pin On Road To Revolution Project

Pin On Making Money Online The Right Way For Anyone

Richard Burgon Mp On Twitter Richard Investing Twitter

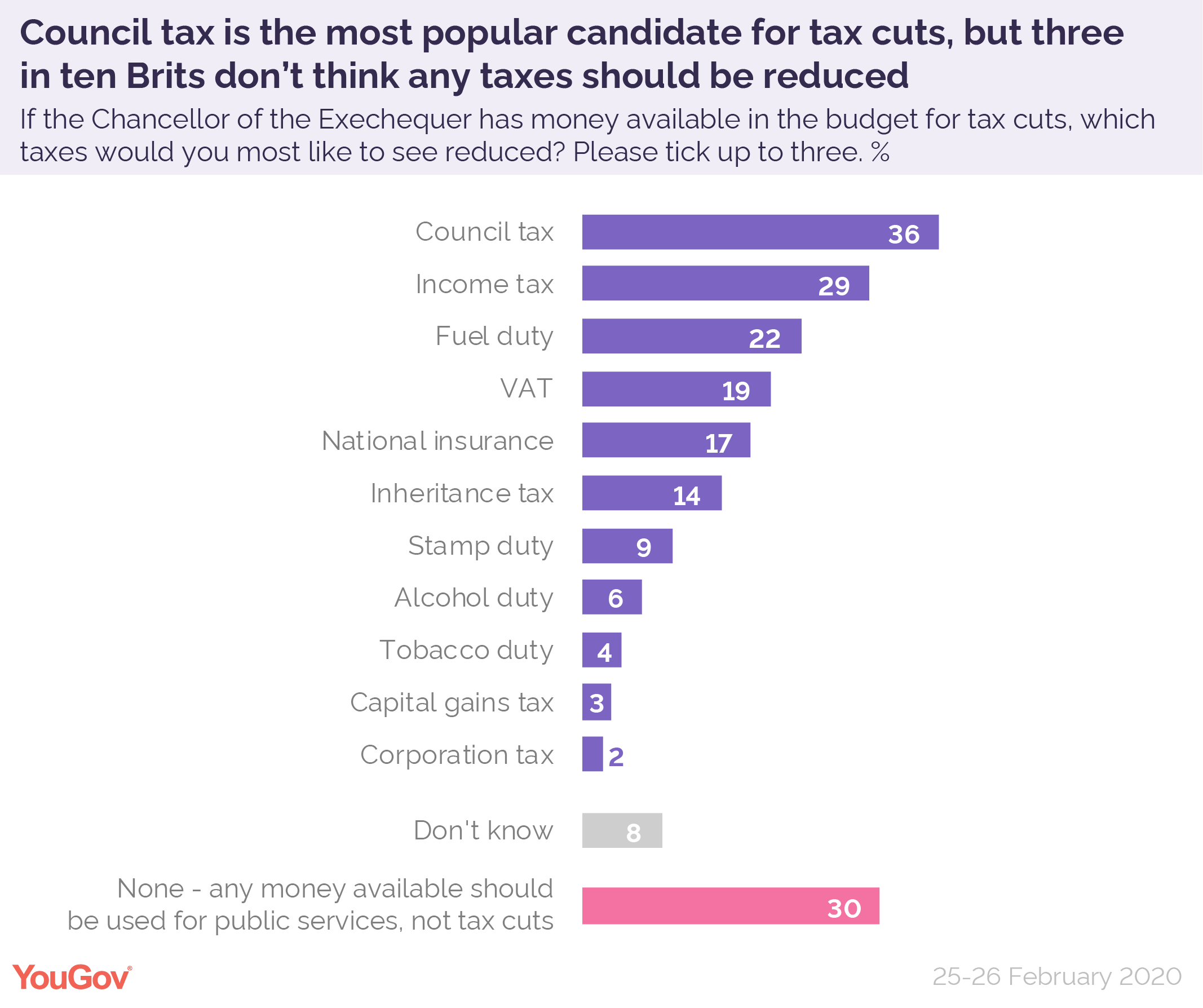

Budget 2020 What Tax Changes Would Be Popular Yougov

How Do Taxes Affect Income Inequality Tax Policy Center

People Are Making Fun Of Rich People Who Are Afraid Of Biden S Tax Plan 46 Pics Cool Things To Make Rich People How To Plan

How Do Taxes Affect Income Inequality Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Taxes Affect Income Inequality Tax Policy Center

Switzerland Tax Income Taxes In Switzerland Tax Foundation

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)