idaho child tax credit 2021

The only caveat to this is if you and your childs other parent dont live. To be a qualifying child for the 2021 tax year your dependent generally must.

Child Tax Credit 2022 Could You Get 450 Per Child From Your State Cnet

Verifying Your Identity to View Your Online Account Earned Income Tax Credit Businesses and Self Employed These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022.

. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. House Bill 276 Effective January 1 2021 State and local tax workaround allowed A pass-through entity can elect to pay Idaho tax at the entity level as a workaround for the 10000 limit on the federal deduction for state and local taxes.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Updated January 11 2022 Q B2.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B. Only one parent can get the credit for a shared dependent. The IRS has confirmed that theyll soon allow claimants to adjust their.

Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child. As part of the 2017 tax overhaul Congress doubled the existing child tax credit to 2000 per child under age 17 at year-end. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17.

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew. Child tax credit allowances are. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly.

E911 - Prepaid Wireless Fee. Fuels Taxes and Fees. For children under 6 the amount jumped to 3600.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. If youre the one who claimed the child on your latest 2020 tax. Children who attend college are qualifying children for the Child Tax Credit if they meet the age and other requirements described in the next section.

Updated March 8 2022 Q C2. For 2022 that amount reverted to 2000 per child dependent 16 and younger. Or December 31 at 1159 pm if your child was born in the US.

Raising the qualifying age for the Idaho child tax credit Increasing the expenses allowed for the childdependent care deduction Changes in reporting the charitable deduction for taxpayers taking the standard deduction. Parents income matters too. Electricty Kilowatt Hour Tax.

The short answer is no. Why am I required to authenticate my identity. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022.

The maximum child tax credit is 3600 per child under age six and 3000 per older child Most people will receive half of their eligible CTC through advance monthly payments starting in July and going through December 2021 The IRS has created three online portals that allow you to check your eligibility sign up or opt out of advance payments. These expanded increased and refundable tax breaks apply for the 2021 tax year and an individual or household can claim both. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

Advance Child Tax Credit Earned Income Tax Credit Businesses and Self Employed Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The economic stimulus law called the American Rescue Plan raised the existing child tax credit from 2000 per child to 3000 per child for children over age 6. Instruction changes for 2021 income tax returns Recent laws have changed some 2021 income tax instructions.

Who was eligible for advance Child Tax Credit payments. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. What is the amount of the Child Tax Credit for 2021.

Miscellaneous business income tax changes have been adopted see Conformity Page for details. The individual income tax rate has been reduced by 0475. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

June 21st 2021 ChildTaxCredit Awareness Day. The annual election and related tax payment must be made by April 15 of the following year. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

2021 Idaho Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self Employed These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Added June 22 2021 Q K2. On March 12 2018 Governor Butch Otter signed legislation to enact a state-level Child Tax Credit worth 130 per child as part of a larger income tax cut package. 4848 5454 6767 7379 73 79006 plus044 plus071 plus105 plus1000 of the amount over 483100 of the amount over 544500 of the amount over 675500 of the amount over 736500 of the amount over 79.

Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child. The top rate for individuals is now 6925. To be eligible for the maximum credit taxpayers had to have an AGI of.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic K. Business income tax return changes. It is a dollar.

It doesnt matter if they were born on January 1 at 1201 am.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/JICXAK3AT5GGPCMLLSGVXJ7Q7Y.jpg)

Child Tax Credit Irs Sending Letter With Tax Filing Info To Those Who Received Payments Boston 25 News

Child Tax Credit 2021 What To Do If You Missed Irs Deadline Money

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 How Much Is The Child Support In These 10 States Marca

Have Questions About The New Expanded Federal Child Tax Credit Here S How It Will Work Idaho Capital Sun

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Idaho Families Would Benefit From Move To Include More Children In State S Child Tax Credit Idaho Center For Fiscal Policy

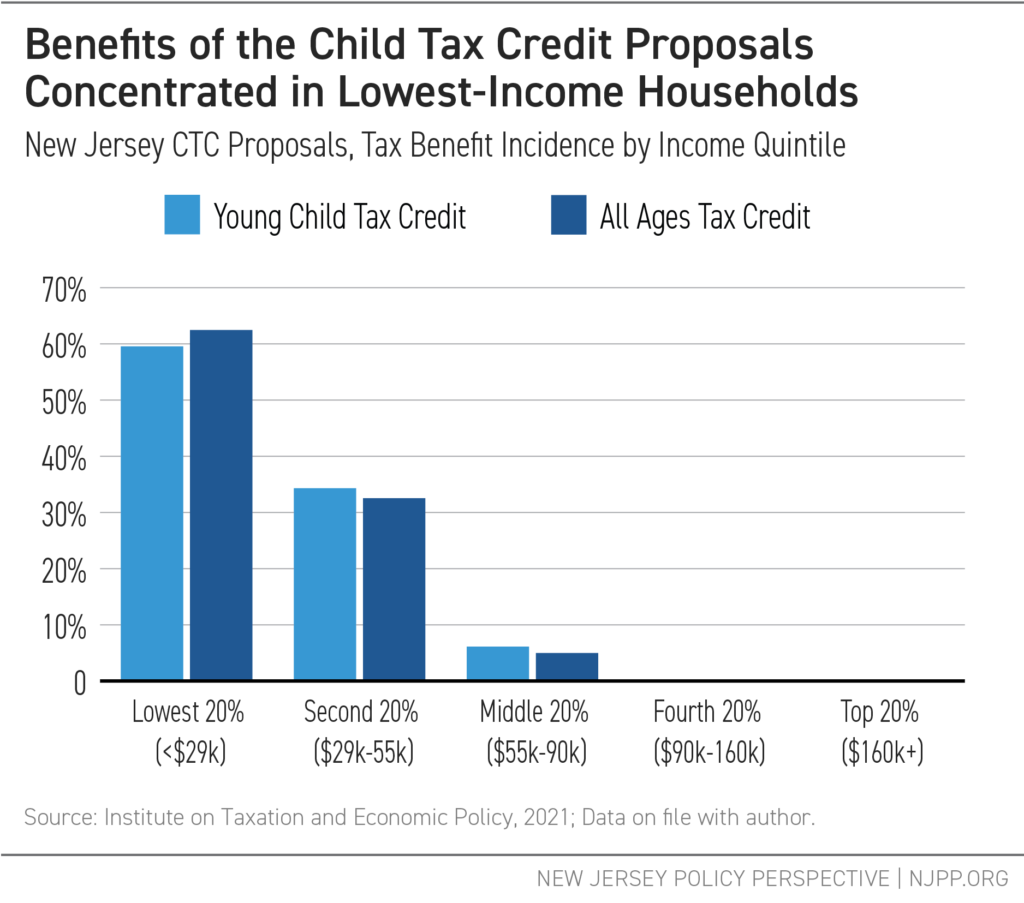

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Want More Child Tax Credit Money File Your 2021 Taxes Money

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Child Tax Credits The 12 States Are Offering Worth Up To 1 000 In Payments To Parents Marca

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Child Tax Credit Update 10 States Offering Their Own Benefits Gobankingrates

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep